E-2 INVESTORS VISA REQUIREMENTS USA

The E-2 Temporary or Non-Immigrant Visa has increasingly become a popular alternative to the EB-5 or Special Immigrant Visa afforded to those who can create employment through substantial investments.

Most potential investors do not have such huge capital requirement or not willing to shell out that much financial resources under the EB-5 and thus, content themselves with an E2 Visa instead.

An E-2 Investor’s Visa a temporary or non-immigrant visa issued to a national from certain treaty countries who wants to invest in U.S. businesses, and who want to temporarily stay in the U.S. to develop and direct the operations of an enterprise or is actively in the process of investing, a substantial amount of capital in a bona fide enterprise.

There are over 80 countries that are signatories to treaties or other arrangement with the U.S.

An E-2 Investor Visa allows an someone to work inside of the United States based on a substantial investment they will be controlling, while inside the United States.

Investor visas are available only to citizens of certain countries.

E-2 Investor must be a National of the Country with which the U.S. has a Treaty of Commerce and Navigation who has invested or in the process of investing a substantial amount in a bona fide enterprise which the person intends to develop and direct with the intention to depart the U.S. when the E-2 Investors Visa expires.

Not only individuals can be considered Treaty Investors but a legitimate business enterprise or organization at least 50 percent owned by persons in the U.S. having the nationality of the treaty country and maintaining nonimmigrant treaty investor status (8 C.F.R. 214.2 (e) (3) (i) (ii));

If the employee is in or (also given an E-2 Visa) is coming to the U.S. to engage in duties of an executive or supervisory character, or, if employed in a lesser capacity, the employee has special qualifications that make the alien’s services essential to the efficient operation of the enterprise.

The employee must have the same nationality as the E-2 Treaty Investor. In addition, the employee must intend to depart the U.S. upon the expiration or termination of E-2 status.

The term “substantial investment” is not defined as the amount depends on the total cost or value of the business and nature of the business. There is no hard and fast rule as to the amount of investment that the USCIS finds “substantial”.

We have seen $50,000 to $300,000 approved by the USCIS. A substantial amount of capital constitutes an amount which is:

- (i) Substantial in relationship to the total cost of either purchasing an established enterprise or creating the type of enterprise under consideration;

- (ii) Sufficient to ensure the treaty investor’s financial commitment to the successful operation of the enterprise; and

- (iii) Of a magnitude to support the likelihood that the treaty investor will successfully develop and direct the enterprise. Generally, the lower the cost of the enterprise, the higher, proportionately, the investment must be to be considered a substantial amount of capital (8 C.F.R. 214.2 (e) (14).

For more details on this issue, we strongly suggest you call our law offices to discuss this matter further.

A marginal enterprise is an enterprise that does not have the present or future capacity to generate more than enough income to provide a minimal living for the treaty investor and his or her family. Thus, it is imperative to submit a 5-year Business Plan that will show the projected future income-generating capacity from the date the alien commences the normal business activity of the enterprise (8 C.F.R. 214.2 (e) (15)).

Thus, a business that may not have a good income today, but has the present or future capacity to earn good income and provide positive economic impact such as employing U.S. workers, is NOT a marginal enterprise.

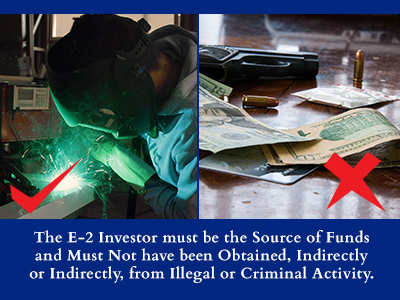

According to the USCIS, the E-2 Visa Applicant must demonstrate the means obtaining the funds which must not come from illegal or criminal activities. Merely providing a self-serving Affidavit or Declaration does not suffice as sufficient documentation must be submitted to show the paper trail of these funds. Clear and legitimate path must be shown between the E-2 Investor’s U.S. Investment and any funds transferred from another country, other entities or individuals, such as spouse or family members, to support the investment.

Personal loans from friends or relatives are allowed provided that the business is not used as collateral.

The collateral, if any, must be the personal assets of the E-2 Investor. Monetary gifts are also permitted. In all cases, these funds must be fully documented.

The Investment must be AT RISK with the Objective of Generating Profit. According to the USCIS, the capital invested must be in the control of the E-2 Investor and subject to partial or total loss should the business fails or irrevocably committed to the enterprise.

Such investment must be the investor’s unsecured personal business capital or capital secured by personal assets.

Potential investors under the E-2 Visa Category who are currently in another non-immigrant status and physically present in the U.S. may apply for a change of status through the USCIS Form I-129 (while their spouses or dependents shall submit the USCIS I-539); while those who are settled abroad will have to course their applications through their E2 Visa Application with the Department of State, Visa Office (DS-160).

In the latter case, we recommend visiting the website of the U.S. Embassy or Consulate Office located in their respective home countries to secure more information on the E-2 Visa application as each Visa Office has its own policy on the matter.

E-2 investors may change status together with or may be accompanied (or followed by) spouses and unmarried children who are under 21 years of age. E-2 Investors are only authorized to work in their own business that was established using their investment but does not preclude additional business; while spouses of E-2 workers may also apply Employment Authorization Document (EAD) with the USCIS that will allow them to work in the same business or elsewhere.

E-2 Visa Treaty investors and employees will be allowed a maximum initial stay of two (2) years. Requests for extension of stay may be granted in increments of up to two years each. There is no time limitation as long as the business is operational and earning more than enough to support the family of the E-2 Investor. Once a child of the E-2 Investor becomes 21 years old, he or she will no longer be included in the renewal application. The E-2 treaty investor or employee may travel abroad and will generally be granted an automatic two-year period of readmission when returning to the United States. The new readmission period also covers family members who are accompanying the Treaty Investor or Employee.

If you’re looking for US Immigration Services, Ponferrada Law Offices – attorneyhelpsyou.com offers excellent, quick and quality legal service with fast communication at the least possible cost.